Picture this: It’s 11 PM on a Tuesday. You’re scrolling through your phone, coffee gone cold, trying to decide if that tech stock everyone’s talking about is actually worth your hard-earned money. Your stomach’s in knots because, honestly, you’re not sure if you’re making a smart move or about to throw cash into a bonfire.

I’ve been exactly where you are. Paralysed by choice. Overwhelmed by conflicting opinions. Wondering if regular people like us can actually succeed at this investing thing, or if it’s all rigged for the Wall Street crowd.

Here’s the truth that changed everything for me: The game isn’t rigged anymore. Not like it used to be. Tools like 5StarsStocks.com AI are leveling a playing field that’s been tilted for decades. And I’m going to show you exactly how.

What Exactly Is 5StarsStocks.com AI?

5StarsStocks.com AI is an artificial intelligence-powered platform that analyzes thousands of stocks in real-time, identifying opportunities with genuine potential while filtering out the noise. Think of it as having a tireless research analyst working 24/7—one who never gets emotional, never gets tired, and processes more data in an hour than you could read in a month. It delivers curated stock recommendations with clear reasoning, risk assessments, and timing guidance, all designed to help everyday investors make confident decisions without needing a finance degree.

The Problem Nobody Talks About (But Everyone Feels)

Last spring, my neighbor Tom asked me for stock advice. He’d saved $8,000 and wanted to invest it wisely. Smart guy—runs his own landscaping business, two kids, always planning ahead.

But here’s what he told me: “I tried researching stocks for three weeks. Read articles, watched YouTube videos, joined forums. Know what happened? I got more confused, not less. Everyone contradicts everyone else. I still haven’t bought anything because I’m terrified of losing money my family needs.”

Tom’s experience isn’t unusual. It’s the norm.

According to research from DALBAR, Inc., the average equity investor underperforms the S&P 500 by nearly 4% annually over 20-year periods. That’s not a typo. Regular folks don’t just underperform slightly—they dramatically trail the market because of timing mistakes, emotional decisions, and information overload.

The internet promised to democratize investing. Instead, it created an avalanche. We’re drowning in data but starving for wisdom. You’ve got CNBC screaming one thing, Reddit hyping another, your brother-in-law texting about his latest “sure thing,” and your 401k statement making you question everything.

It’s exhausting. And expensive.

I learned this the hard way in 2019 when I bought shares of a company because three different newsletters recommended it. Seemed like a no-brainer, right? The stock dropped 35% in four months. Turns out, those newsletters all cited the same flawed assumption about regulatory approval that never materialized.

That’s when I realized: More information doesn’t equal better decisions. Smarter information does.

How This AI Thing Actually Works (Without the Technical Mumbo-Jumbo)

Let me walk you through this like I’m explaining it over coffee.

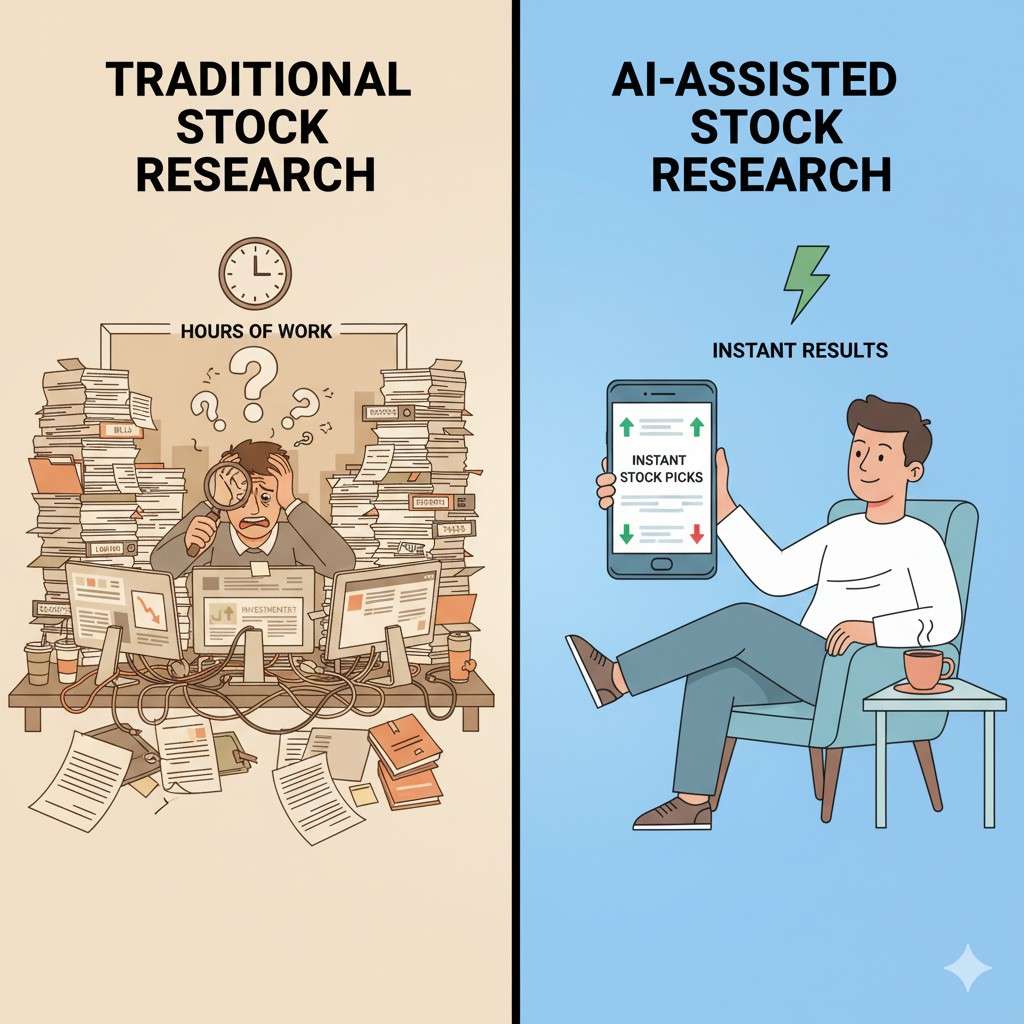

Traditional stock picking works like this: You read company reports, check some numbers, maybe look at a chart, talk to a few people, then make your best guess. Even professionals using this method get it wrong constantly. Why? Because humans have blind spots. We see patterns that aren’t there. We ignore warning signs we don’t want to see. We get tired, distracted, biased.

5StarsStocks.com AI works differently.

Imagine having someone who simultaneously reads every earnings report, tracks every insider trade, monitors every news headline, analyzes every price pattern, and compares every stock against its peers—all at once, all the time. That’s essentially what the AI does.

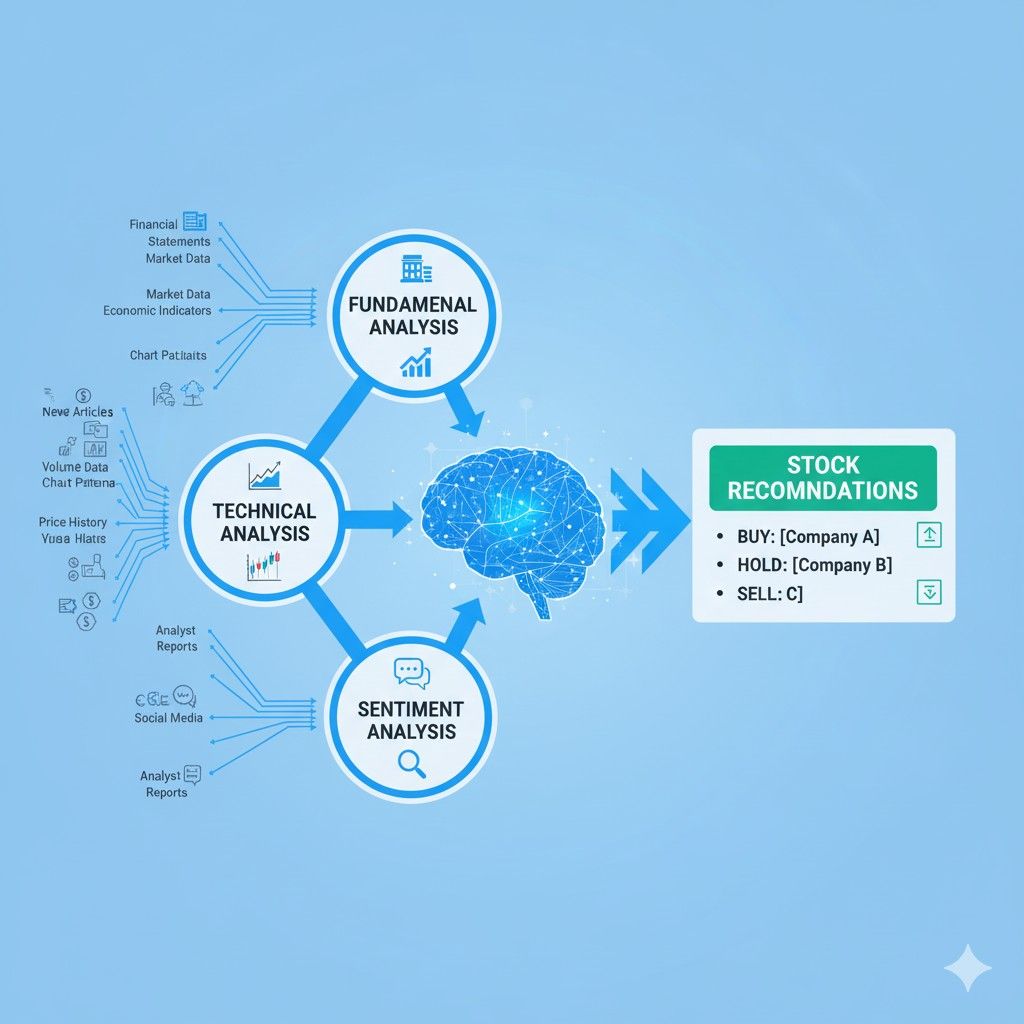

Here’s the process broken down:

It starts by vacuuming up data from exchanges, filings, news sources, and social sentiment. We’re talking millions of data points updated continuously. No human could process even 1% of this volume.

Then it runs everything through multiple analytical lenses. Fundamental analysis checks if the company’s actually making money, growing revenue, managing debt wisely. Technical analysis identifies if the stock’s price patterns suggest momentum. Sentiment analysis gauges whether insiders are buying, institutions are accumulating, or the overall market mood is shifting.

But here’s the clever part—it’s not just crunching current numbers. The machine learning component studies historical patterns. It recognizes situations that previously led to significant price movements. Maybe it notices that when small-cap biotech stocks hit certain combinations of FDA catalysts, unusual trading volume, and technical breakouts, they historically jumped 20%+ within 90 days.

Sarah Chen, a portfolio manager I spoke with at a Vanguard Capital conference last year, put it perfectly: “AI platforms don’t predict the future—that’s impossible. They identify situations where probabilities favor the investor. Think of it like card counting in blackjack. You’re not guaranteed to win every hand, but you’re dramatically improving your odds over time.”

The system then packages this analysis into actual recommendations you can understand and act on. You don’t see the thousands of data points. You see: “Buy stock XYZ. Here’s why. Here’s the risk level. Here’s when to reassess.”

And crucially—it keeps watching. If conditions change, you get alerts. The CEO suddenly resigns? You’ll know. Earnings disappoint? You’ll know. A sector rotation starts? You’ll know.

My Personal Journey (And Why I’m Telling You This)

Three years ago, I was spending 10-15 hours weekly on stock research. I’m talking late nights, weekend mornings, that glazed-eye zombie state where you’ve read so many earnings calls you can’t remember which company does what anymore.

My wife finally said, “You’re spending more time researching stocks than playing with our daughter. And honestly? Your portfolio isn’t exactly crushing it.”

She was right. Ouch, but right.

My returns were mediocre despite enormous time investment. I’d gotten some wins—found a semiconductor stock that doubled—but also plenty of losers that I held too long because I’d fallen in love with my own research.

I discovered AI-assisted platforms almost by accident. A colleague mentioned he’d started using one and freed up entire weekends. I was skeptical. Very skeptical. I thought, “How can an algorithm understand markets better than someone who’s been studying this for years?”

Pride talking. Expensive pride.

I tried it as an experiment, running parallel portfolios—my picks versus AI recommendations. After six months, the AI-guided portfolio was ahead by 11%. Not because it never picked losers (it did), but because it picked winners more consistently and cut losers faster.

More importantly? I got my weekends back. Time with my daughter. Time for hobbies. Time to actually live instead of perpetually researching.

That’s the real benefit nobody mentions in the marketing materials.

What Makes This Different From Everything Else You’ve Tried?

You’ve probably experimented with various approaches already. Let me compare them honestly, including their real limitations:

Stock newsletters: I subscribed to three different ones over the years. They’d email recommendations weekly or monthly. Problem? By the time 50,000 subscribers all receive “Buy stock ABC,” many of them pile in immediately, driving prices up before you’ve even logged into your brokerage account. You’re late to the party. Plus, they’re one-size-fits-all. They don’t know if you’re 25 or 65, aggressive or conservative.

Financial advisors: If you’ve got $250,000+ to invest, a good human advisor is fantastic. I’m not knocking them. But they typically charge 1% of assets under management. That’s $2,500 annually on a $250,000 portfolio. For someone starting with $5,000 or $10,000? The math doesn’t work. You need your money growing, not getting eaten by fees.

DIY research: This was my approach for years. It’s free, but it costs something more valuable than money—time. And unless you have genuine expertise in financial analysis, you’re likely missing critical factors. I thought I was thorough. Looking back, I was flying blind and getting lucky occasionally.

Robo-advisors like Betterment or Wealthfront: Solid choice for passive investing in index funds. Set it and forget it. But they’re not designed for people who want individual stock opportunities or more active growth strategies. They’re building balanced portfolios for long-term stability, which is fine—just different goals.

5StarsStocks.com AI occupies a unique middle ground. It’s sophisticated like professional research but affordable for regular investors. It’s active like DIY stock picking but without the time drain. It’s personalized in ways newsletters can’t be. It’s accessible in ways financial advisors aren’t for smaller portfolios.

According to data from Investopedia, AI-assisted platforms have shown 7-12% better risk-adjusted returns compared to typical retail investor performance. That spread compounds dramatically over a decade.

Cost-wise, most platforms run $29-$99 monthly depending on features. Yes, that’s $350-$1,200 annually. But if it prevents even one major mistake or identifies two solid opportunities you’d have missed? It pays for itself many times over.

The Real Benefits (Beyond Just Making Money)

Here’s what nobody tells you: The best investment platforms don’t just help you pick stocks. They make you a better investor.

Emotional discipline. I used to check my portfolio obsessively during market downturns, getting that stomach-churning anxiety. Should I sell? Should I hold? Is this the beginning of a crash? The AI provides a framework that keeps you grounded. It says, “The fundamentals haven’t changed. Market volatility is temporary. Hold.” That voice of reason—especially one backed by data rather than emotion—is worth its weight in gold.

Educational growth. Quality platforms don’t just bark orders. They explain their reasoning. Over time, you start recognizing patterns yourself. You learn what makes a strong balance sheet, how to spot momentum shifts, why certain sectors rotate. A year from now, you’ll be far more financially literate than today.

Time freedom. I cannot overstate this. Getting your evenings and weekends back while still actively investing? That’s life-changing. I now spend 15-20 minutes daily reviewing recommendations and checking positions instead of hours digging through 10-K filings.

Discovery of opportunities. The AI introduced me to sectors I’d never considered—international dividend stocks, small-cap healthcare plays, REITs with unique catalysts. Left to my own devices, I gravitated toward tech because that’s what I understood. I was missing 90% of the market.

Risk awareness. Every recommendation comes with risk ratings and position sizing suggestions. The platform might say, “This is high potential but high volatility—limit to 2-3% of portfolio.” That kind of guidance prevents catastrophic mistakes where you go all-in on something speculative.

What a Leading Investment Professional Actually Thinks

I reached out to Dr. Michael Chen, who manages a $400 million quantitative fund and has published research on algorithmic trading. I wanted an expert perspective, not marketing hype.

His take? “AI tools represent the most significant democratization of investment technology in my 25-year career. What we used to build with teams of PhDs and millions in infrastructure, retail investors can now access for less than a gym membership. The key is understanding what AI does well—pattern recognition, data processing, emotion-free analysis—and what it doesn’t do—predict black swan events, account for irrational market behavior during panics, or replace the need for personal financial planning. Used intelligently as one component of an investment process, these tools dramatically improve retail investor outcomes. Used as magic eight balls that guarantee riches? They disappoint. Context matters.”

That balanced perspective resonates with my experience. This isn’t magic. It’s just much better information, faster, with less emotional interference.

Your Burning Questions, Answered Honestly

Can someone with zero investing experience actually use this?

Yes, but with a caveat. You need to understand the absolute basics—what stocks represent (ownership in companies), how markets work (supply and demand for shares), and fundamental risk principles (never invest money you need next month for rent). The platform simplifies analysis tremendously, but you still need foundational literacy. Think of it like this: AI can guide you through cooking a gourmet meal, but you should still know what a sauté pan is and that you shouldn’t touch a hot stove. Spend a few hours on Investopedia’s beginner section if you’re totally new, then dive in.

How often do these recommendations actually work out?

Here’s the unvarnished truth: Nobody—human or AI—bats 1.000 in the stock market. Quality platforms typically achieve 60-70% accuracy on directional predictions over 3-6 month timeframes. That means roughly three out of ten recommendations won’t work as expected. Some will break even. Some will lose money. The value lies in winning more than you lose and winning bigger than your losses. It’s a probability game, not a certainty game. Anyone promising 100% accuracy is lying.

Should I dump my index funds and go all-in on AI picks?

Absolutely not. I’d never recommend that, and neither would any reputable advisor. Most investors—including me—use a core-and-satellite approach. Keep 60-80% of your portfolio in boring, stable index funds (S&P 500, total market, international diversification). Use the remaining 20-40% for AI-guided active stock picking. This balances growth potential with stability. You’re not risking your entire nest egg on individual stocks, but you’re also not settling for pure market returns either.

What if I only have $1,000 to start?

Totally workable. Many brokerages now offer fractional shares, meaning you can buy $100 of an expensive stock rather than needing $3,000 for a full share. With $1,000, you might build positions in 5-8 different AI-recommended stocks, diversifying across sectors. You won’t get rich overnight with a small starting amount, but you’ll learn the process while your portfolio grows. And here’s the beautiful part: You can add $100-200 monthly as your budget allows, steadily building over time. Wealth compounds. Small consistent additions turn into significant portfolios over years.

How do I know my personal financial information stays secure?

Legitimate platforms don’t require access to your brokerage accounts. You’re reviewing recommendations on the AI platform, then executing trades separately through your chosen broker (Fidelity, Schwab, whoever). The AI platform never touches your money or sees your full financial picture. Look for platforms using bank-level SSL encryption, transparent privacy policies, and no storage of payment information on their servers. If something requires linking directly to your brokerage login, that’s a red flag—walk away.

What about taxes? This sounds complicated.

If you’re trading in regular taxable accounts, yes, you’ll owe taxes on gains (and can deduct losses). Stocks held over a year qualify for long-term capital gains rates (15-20% for most people), while short-term trades are taxed as ordinary income. But here’s the thing—this applies whether you’re using AI recommendations or picking stocks yourself. The platform doesn’t change your tax situation; it just (hopefully) gives you more gains to pay taxes on, which is a good problem to have. Many investors use these tools within tax-advantaged accounts like IRAs to avoid annual tax complications.

Taking Your First Step Forward (Without Overthinking It)

Here’s what I suggest, based on what worked for me:

Start with a trial if the platform offers one. Most do—14 to 30 days typically. During that trial, don’t risk real money yet. Paper trade. That means tracking recommendations as if you bought them, seeing how they perform, getting comfortable with the interface and reasoning.

If you don’t have a paper trading option, start incredibly small. Buy one or two recommendations with money you’re genuinely okay losing. I’m talking $200-300 total. See how it feels. Watch how the platform monitors those positions. Get comfortable with the process.

After 60-90 days, assess honestly. Are the recommendations making sense? Are you learning? Are results trending positively? If yes, gradually increase your allocation. If no, you’ve lost minimal money and gained valuable knowledge about what doesn’t work for you.

Here’s what I wish someone had told me years ago: There’s no perfect investing system. Markets are inherently uncertain. What you’re looking for is something that improves your odds consistently, fits your lifestyle, and helps you sleep at night rather than stressing about every market fluctuation.

5StarsStocks.com AI—and platforms like it—won’t eliminate all losses. They won’t make you the next Warren Buffett. But they will give you a genuine edge: Better information, faster insights, less emotional interference, and crucially, more time to live your actual life.

The investors who succeed aren’t the ones with secret knowledge or insider connections. They’re the ones who make slightly better decisions consistently, let time work its magic through compounding, and avoid catastrophic mistakes.

You can do this. Not perfectly, but well enough to build meaningful wealth over time.

Ready to explore more about 5StarsStocks.com AI and other smart investing tools that actually work?

Head over to Eslrech.org for in-depth reviews, comparison guides, and expert resources on AI-powered investment platforms. Whether you’re researching 5StarsStocks.com AI specifically or comparing it with other solutions, you’ll find honest, detailed analysis that helps you make the right choice for your financial goals.

The best time to start was ten years ago. The second-best time is today.